There is currently a global trend, of inflation, sky high commodity prices, record real estate prices and stagnant wage growth. At home in Australia there is a growing fear that some of the younger generations will rent for life. They are treading water not getting ahead. As housing affordability asymptotes towards the unachievable, I find myself asking the question is this a problem government has to fix, or should they remove red tape, allow the amount of stock to increase and let free markets correct themselves?

What are the positions of some of the political parties on housing policy in the lead up to the 2022 Federal Election? What is your opinion on what is being proposed? Do you think the proposed policies will improve things like housing affordability? If you haven’t read much about them yet, in no particular order here is what some of the parties have on the table for hosing this election. We would love to hear what your thoughts are on some of these proposed changes.

Liberal National Party (LNP)

The Libs actually have quite a range of proposed initiatives that they are touting at this federal election. It is almost like they are afraid of not winning an election. They are all fairly moderate measures.

They plan to increase the number of people they allow access to the home guarantee scheme each year. This scheme allows people to access housing with a deposit as low as 5%. They are wanting to increase this so that a maximum of 35,000 people each year will be able to use this.

They also wish to incentivise the construction of new homes in regional areas. They plan to do this by giving up to 10,000 people living in regional Australia access to the 5% deposit scheme also. There will be access to the scheme for up to 5000 single parents per year also.

They will also be increasing the caps on the amount that people will be able to spend when accessing this scheme.

A few fairly ok incentives there but I also feel as though there is not enough to sink my teeth into. Do you think this is too little too late, or do you think there are the incentives we need?

Australian Labor Party (ALP)

The Labor party is taking one main proposed piece of housing policy to this may election.

This is known as the help to buy scheme. The proposed plan will allow up the 10,000 people a year to purchase a home with a 2% deposit. The scheme will be for singles that earn up to $90k/year and couples that earn up to $120k/year. This will be facilitated by having the federal government own a 30-40% equity stake in the home. The person that is buying the home then has the option to start buying back the equity, or they can leave it the way it is and the government will only get their money back once the property is sold.

It is important to keep in mind that they will be taking park of the capital gains on the property because they do have an equity stake in the property. While this will make it easier for low-income earners to get into a home they own. It does nothing to improve supply of new housing and really will only add fuel to the fire that is the demand on housing.

http://https://www.youtube.com/watch?v=ugHiEYHNFt0

United Australia Party (UAP)

As for the UAP, they always have been a bit of a disruption on the political stage. If you have an interest in politics despite your stance one has to admit that when an outspoken billionaire is the chairman of a political party it does make for in interesting theatre.

None the less the party has two main changes that in their arsenal that they view as being the right solution to Australian housing policy.

3% Interest rate cap

The first and perhaps most well-known policy they would like to see is interest rates for home loans locked in at a maximum of 3% for the next 5 years. They argue that if interest rates reach 5-6% then somewhere in the vicinity of 40-80% of Australians will experience mortgage stress or worse lose their homes.

What this is a simple and interesting fix. However, is it even within the power of the federal government to control interest rates? What legal and policy measures that they can draw upon in order to even achieve something like this? I honestly don’t know myself. The other possibility is that this is simply something they are putting out there, knowing full well that they will never be held accountable and won’t have to couch up with the results. What are your thoughts?

Tax Deductions for home loans

Their other proposal is to make it so that the first $30,000 paid on a home loan tax each year is tax deductible.

The Australian Greens Party

The greens stand behind their ideology that housing is a human right. While I admire the sentiment, they wish to do this by building 1 MILLION HOMES over the next 20 years. Sounds good right? BUT, How, when, where? I am so glad you asked!

The greens wish to establish a housing trust that will finance the development and delivery of one million homes to people in need and to create affordable housing for low-income earners. While this huge amount of new homes would for sure alleviate the current over demand on housing. It is a pretty tall order. The Greens party claim they are able to fund the policy by taxing billionaires. These homes will be broken up between public housing, homes for Australians to buy and to rent.

Doesn’t sound too bad so far but let’s pick this apart a little. One Million homes, let’s assume that they are able to achieve an average cost of a home delivered for about $500,000. After all of the associated costs; land, construction, financing, and then there is all the bureaucratic paper pushing and pen moving. When all is said and done the greens are talking about spending $500,000,000,000 (500 Billion Dollars) on one policy. Judging by the track record governments have it will take twice as long and cost 3 times as much. What do you think? Is this the right solution?

Final Thoughts

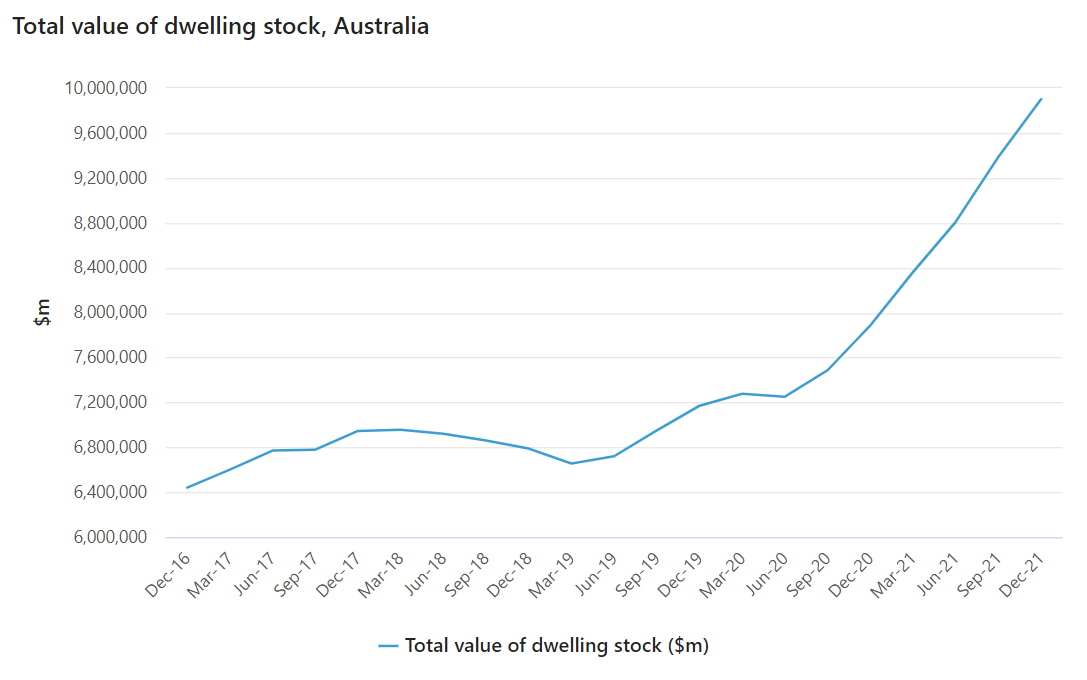

In my view it is not the role of government to step in and fix every issue that someone might experience. However, there are and only ever have been two things that drive markets. Supply and demand! Over the last 18 months we have seen property prices increase in the country by 25%. Some select areas have seen increases of up to 50%. (See graph showing the exponential increase in total dwelling stock value over the last few years).

What is driving this? Insane demand of course! So how do we reduce some of this upward pressure. Well by increasing supply of course! But do any of these proposed policies actually get to the heart of this? With the exception of the greens there is nothing being put forward that will actually increase the supply of stock. But don’t get me wrong, I think the greens promise to build a million homes is tantamount to the kid in primary school promising free lollies at the tuckshop if elected to the student council. Instead of cash handouts, shared equity and low deposit schemes. Where are the mechanisms that will increase supply instead of increasing the demand on the already limited stock?