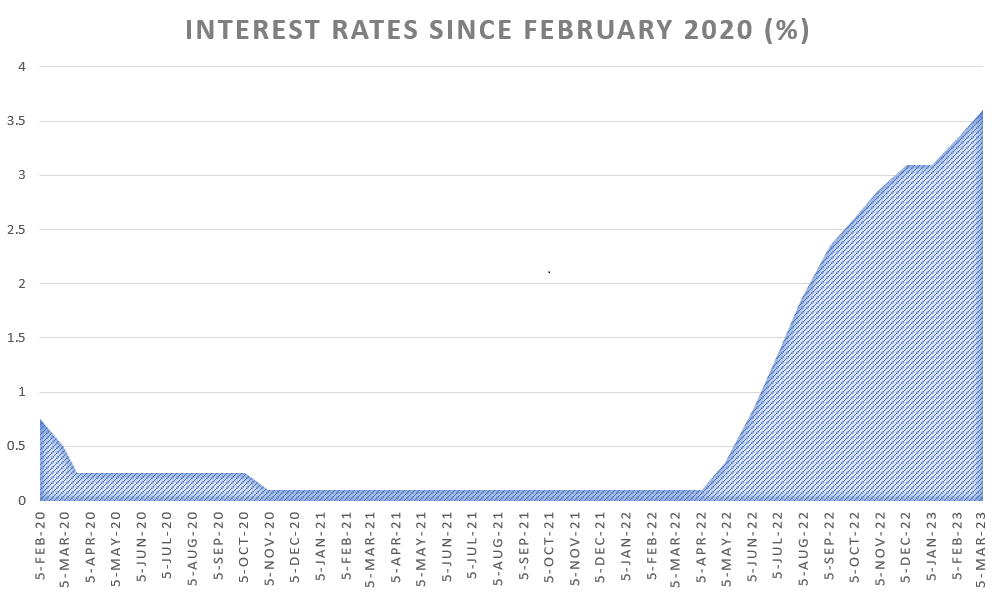

After two years of explosive growth in real estate prices, the dust appears to be settling. With some economists predicting 4 interest rate rises by August 2023, the question on everyone’s lips is: How will this year pan out?

Get An Instant Online Appraisal HERE!

Get A Full Suburb Report HERE!

Consolidation or Resilience?

Those that think they have the answer should lend out their crystal ball, as 2023 will be a difficult one to pick. With a dichotomy of competing forces, it could be a year of consolidation or a year proving just how resilient the Brisbane property market is. A key concern is for those with large mortgages and ballooning payments. They could find themselves in a situation where they can no longer afford to keep the home but can’t afford to sell it either because the value has decreased.

Short Run vs Long Run

However, there is a little writing on the wall. Famous investor Ben Graham said that “In the short run, the stock market is a voting machine but in the long run, it is a weighing machine.” What this means is that in the short term, the stock market is an indication of what an economy is doing, and in the long run, it shows that things do eventually get back on course. So, what is it telling us now? Most major western indices have slipped, and behemoth American companies like Apple, Amazon, Netflix, and Microsoft have announced layoffs totaling in the hundreds of thousands. Along with the rising cost of living, it is pretty clear we are going to see some cooling of the economy.

Managing Finances

For those wanting to manage their finances a bit more responsibly, we recommend that you work to a budget and where possible spend only on essentials. Battle through this period as the outlook is positive. Remember, real estate is a long-term investment. If you can ride the tough times, you will benefit from the peaks.

Infrastructure Development

We are very fortunate to have invested in the south east Queensland property market. There will be unprecedented spend in major infrastructure projects over the coming 10 years. This investment will boost the local economy and drive the need for housing.

Major Projects

Projects like:

- Brisbane International Airport – Is planning to invest more than $5 billion redeveloping the terminals and surrounding precincts.

- $1.8 Billion “City Deal” project. A jointly funded project across all levels of government setup to build new public transport infrastructure including the new Kangaroo Point Green Bridge.

- $1.1 Billion to remove trainline bottlenecks

- Construction of the Breakfast Creek pedestrian Green Bridge

- New Aerospace and Defense precinct for Toowoomba

- $83 million Victoria Park redevelopment

- $2.5 Billion Gabba Stadium rebuild in preparation for the Olympics

- Development of the Breakfast Creek Sports precinct, incorporating a water harvesting and reclamation system for the 2032 Olympics

- Building of an International standard cycling track in Murarrie

- The building of an International Broadcasting Centre in West End

- Redevelopment of Toombul shopping Centre- Mirvac

- Bruce Highway/ Gateway Motorway to Dohles Rocks Rd upgrade

These are just some of the infrastructure projects that are slated for SEQ.

Positive Outlook for Residential Real Estate

Overlay this with historically low vacancy rates for rental properties and we have a positive outlook for residential real estate. Overall, in the near term, it is clear we are headed for a slowdown and tight budgets. Taking form global patterns, we can see that the typical recession lasts 10-18 months. The important opportunity to take from this is that the population in South-East Queensland is growing quicker than the pace of new residential development.

Conclusion

In conclusion, while it is difficult to predict exactly how the property market and the economy will perform in 2023, there are some indications that we may see some cooling in the short term. However, for those with a long-term investment outlook, there are still opportunities to be found in the real estate market. With major infrastructure projects in the pipeline and low vacancy rates, South-East Queensland is a promising area for property investment. It is important to be cautious and responsible with finances during this period of uncertainty, but also to keep in mind the potential benefits that can come from riding out the tough times. Ultimately, while there may be challenges ahead, there are also reasons to be optimistic about the future of real estate in Australia.

Get An Instant Online Appraisal HERE!

Get A Full Suburb Report HERE!

FAQs

- Should I invest in real estate in 2023?

It depends on your personal financial situation and goals. While there may be some short-term uncertainty, long-term investments in real estate can be lucrative. - Will interest rates rise in 2023?

There is a possibility of interest rates rising, as some economists have predicted. However, nothing is certain and it’s important to keep an eye on market trends and news. - Is it a good time to sell my property?

It depends on the current market conditions and your personal financial situation. It’s always a good idea to consult with a real estate agent or financial advisor before making any decisions. - How can I manage my finances during an economic slowdown?

It’s important to create a budget and prioritize spending on essentials. You may also want to consider consulting with a financial advisor to develop a plan for managing your finances during tough times. - Will the cooling of the economy affect the property market?

It’s likely that a cooling of the economy will have some effect on the property market, but the extent of this impact is uncertain. Historically, the property market has shown resilience and tends to recover from downturns in the long term. - How will the infrastructure projects affect the property market?

The major infrastructure projects planned for South-East Queensland are expected to have a positive impact on the property market, with increased demand for housing due to population growth and improved amenities in the region.