One will look back at 2023 and reflect on the turbulence and uncertainty of the year that was. When you consider that the year saw two significant wars erupt, central reserves struggling to reign in domestic inflation globally, supply chain issues bite into everyday costs of living, cyber-attacks and data breaches of some of our largest companies compromise personal data and the ability for many individuals and companies to trade and how COVID-19 is a virus that just won’t go away. Many will celebrate the new year and the optimism of hope and stability in 2024.

But how did all these macro factors affect the Inner North Brisbane real estate market? Let’s look at interest rate increases.

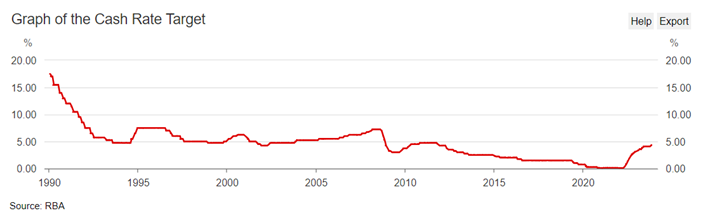

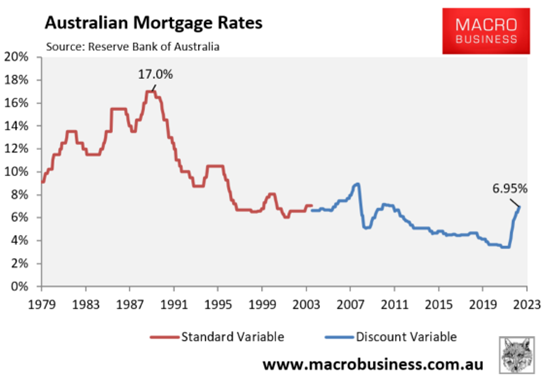

The RBA cash rate as of December 2023 is 4.35%. This is the highest it has been since February 2012 (4.25%). Yet many of us with mortgages were too young to experience the cash rate of 17.5% in January 1990. Now we are not suggesting that it will reach those heights again, but a rate band of 7% – 7.5% is what Australia experienced for 13 years between 1995 – 2008. In real terms, money is still cheap when compared to this 13-year period.

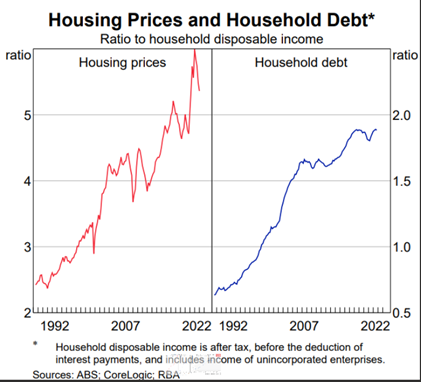

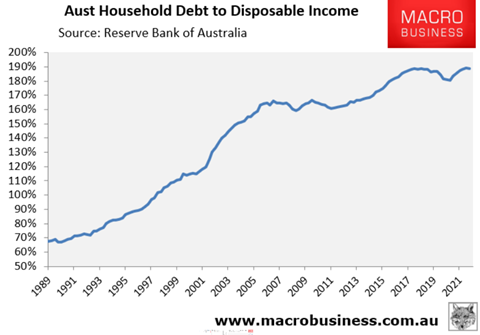

And although the current cash rate is far from the 17.5% peak reached in 1990, there has been a substantial surge in house prices relative to incomes since then. In 1990, the national median house price stood at approximately 3.1 times the average household income, soaring to a peak of 6.6 times in the March quarter of 2022, nearly double the ratio observed three decades ago.

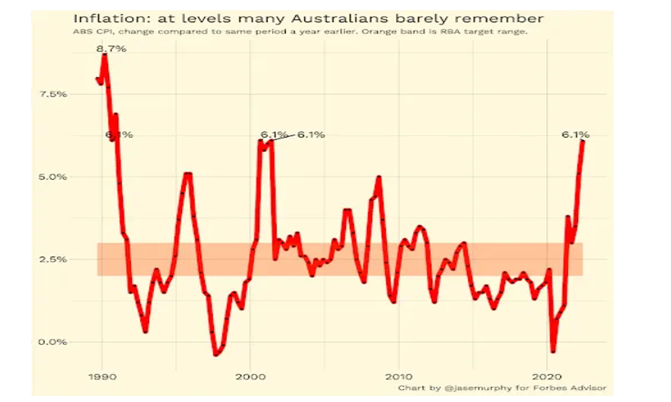

Inflation has rocketed since COVID-19. Government spending designed to get economies going worked, but when overlaid with global supply chain issues it was the perfect storm to overheat the economy. This puts the spotlight on the RBA. The RBA’s job is to control inflation. An extract from the media release distributed by Michele Bullock, Governor of the RBA in November 2023 states:

“Inflation in Australia has passed its peak but is still too high and is proving more persistent than expected a few months ago. The latest reading on CPI inflation indicates that while goods price inflation has eased further, the prices of many services are continuing to rise briskly. While the central forecast is for CPI inflation to continue to decline, progress looks to be slower than earlier expected. CPI inflation is now expected to be around 3½ per cent by the end of 2024 and at the top of the target range of 2 to 3 per cent by the end of 2025. The Board judged an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe.”

One can expect further increases in the cash rate as the RBA reigns inflation in.

How has the properties market performed?

After a cautious start to the year buyers jumped back into the inner north real estate market with confidence once the aggressive rate rise settled in June 2023. Units and town houses were in huge demand by first home buyers. This is because of the rental shortage crisis, dramatically increased weekly rental prices and interest rate increases compressing buyers into lower price points.

The following is an extract from a report dated 23 November 2023 written by Core Logic.

Australian dwelling values have regained the losses from the recent downturn and surpassed their previous peak to reach a new record high.

After reaching a peak in April 2022, national home values fell -7.5%, finding a floor on 29 January 2023. Since bottoming out, the national HVI has risen by 8.1%, taking the market to a new record high on Wednesday 22 November 2023.

CoreLogic’s Executive Research Director, Tim Lawless, said it took around nine months for the National HVI to move from record highs to the recent trough, then roughly ten months to recover from the short but sharp downturn.

“The ‘V’ shaped recovery may seem counter intuitive, given high interest rates, deeply pessimistic levels of consumer sentiment and high cost of living pressures, however the recovery can be explained by an imbalance between supply and demand,” Mr Lawless said.

Supply and demand. In other words, listed available properties for sale are less than the buyer demand, driving prices up. How did this look in some Northern Brisbane suburbs?

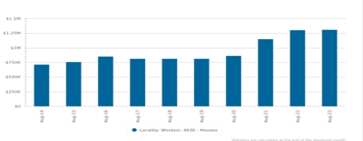

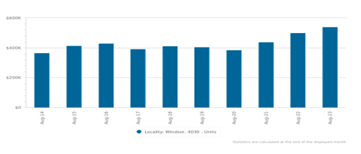

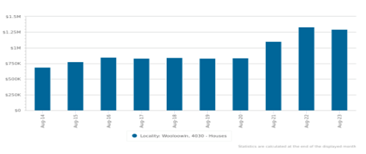

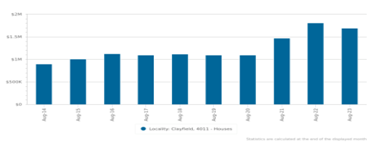

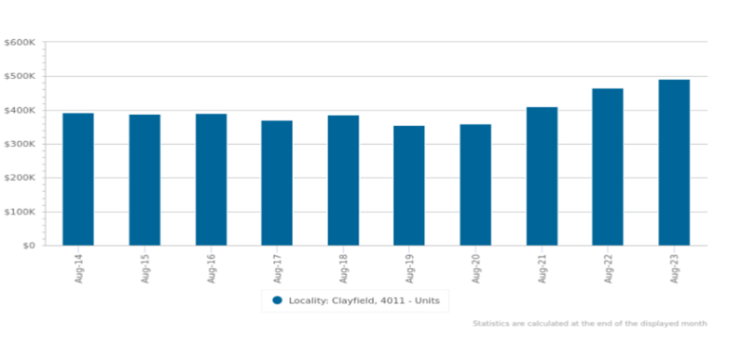

Except Lutwyche houses, every other suburb analysed (Clayfield, Wooloowin, Windsor) experienced an increase in median values in 2023. The following charts from CoreLogic track medium values between houses and units by suburb.

Change in Medium Value

Lutwyche

Windsor

Wooloowin

Clayfield

When looking at number of sales, some suburbs have performed better than others.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023* | ||

| Lutwyche | Houses | 15 | 28 | 31 | 36 | 20 | 20 | 26 | 36 | 40 | 27 |

| Units | 143 | 193 | 214 | 150 | 46 | 61 | 52 | 88 | 142 | 132 | |

| Windsor | Houses | 88 | 100 | 93 | 82 | 72 | 79 | 76 | 78 | 87 | 71 |

| Units | 158 | 184 | 137 | 64 | 33 | 42 | 62 | 72 | 100 | 124 | |

| Wooloowin | Houses | 54 | 51 | 63 | 58 | 58 | 51 | 33 | 55 | 48 | 37 |

| Units | 53 | 73 | 72 | 37 | 20 | 26 | 33 | 52 | 62 | 36 | |

| Clayfield | Houses | 122 | 113 | 110 | 117 | 125 | 79 | 92 | 146 | 134 | 87 |

| Units | 218 | 210 | 222 | 160 | 137 | 111 | 135 | 223 | 279 | 178 | |

*please note – not a full year

What can we expect from 2024?

Further interest rate increases, and a lack of new construction will put further pressure on buyers in the price brackets below $1,800,000. We believe those selling can expect further windfalls as prices can only continue to increase across both major property classes.